In the financial landscape of the Philippines, the salary loan has emerged as a crucial lifeline for many Filipinos, serving as a means to cover bills and unexpected expenses before the arrival of the next paycheck. Particularly, the Social Security System (SSS) salary loan stands out as a wise choice for individuals facing financial challenges. […]

Category Archives: Loans Philippines

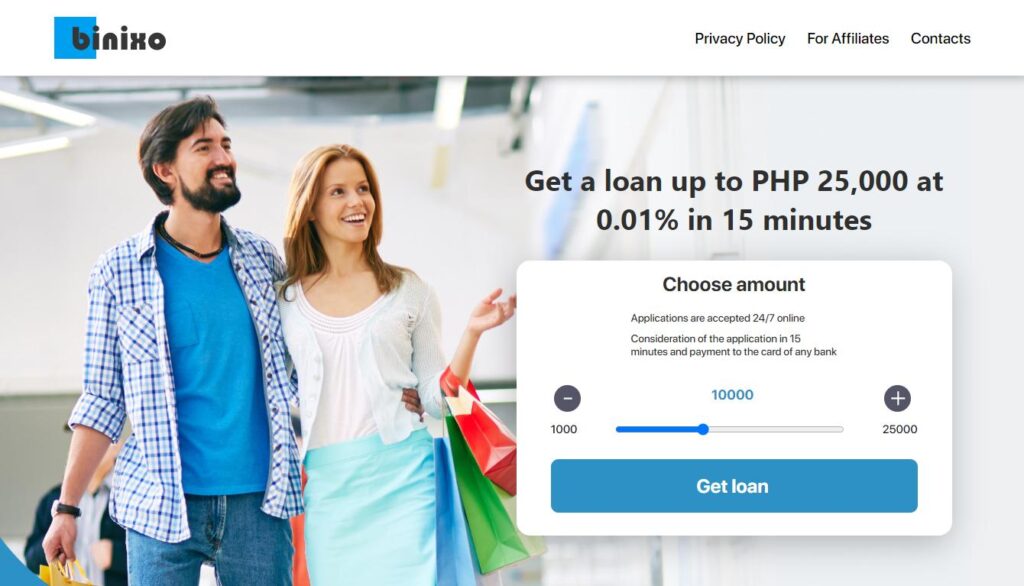

Best Quick Cash Loans in the Philippines: Legit and Fast. Apply fast loan in 15 minutes in the Philippines with 0 interest ☝ High approval rate ⚡ instant and easy application ✓ receive money you need.

In the rapidly evolving landscape of financial services, Binixo Loans has emerged as a focal point, prominently featured on MrCashLoanPH as a distinguished online lending platform in the Philippines. This thorough review seeks to meticulously examine the legitimacy, registration status, and operational intricacies of Binixo Loans. APPLY BINIXO LOAN Binixo Loan Overview Binixo Loan Review […]

The Philippines has some of the most competitive online loan interest rates and fees in the world. With competitive rates and fees, online loans in the Philippines offer borrowers a convenient and fast way to access the funds they need. These loans can be used for a variety of needs, ranging from home improvements to […]

In an ever-changing financial world, where the cost of living continues to rise and financial stability often seems out of reach, the need for quick and accessible cash solutions has never been more critical. Money-related problems can affect anyone, regardless of their background or circumstances. In such situations, turning to family or friends for financial […]

OKPeso positions itself as a swift and convenient online loan application, eliminating the need for collateral. Operated by Codeblock Lending Inc., a reputable financial institution registered with the Securities and Exchange Commission (SEC), it offers borrowers the opportunity to secure loans of up to ₱20,000 with a repayment window spanning from 96 to 365 days. […]