When faced with financial difficulties, many people turn to online loans as a quick solution. While these loans can provide immediate funds, they often come with high interest rates and fees that can trap borrowers in a cycle of debt. Fortunately, there are alternative options available that can help you meet your needs without resorting […]

Category Archives: Loans Philippines

Applying for an online loan in the Philippines has become a convenient option for many individuals who are in need of financial assistance. Whether it’s for emergency expenses, debt consolidation, or funding a business venture, online loans offer a quick and accessible solution. In this article, we will guide you through the process of applying […]

Applying for an online loan can be a convenient and efficient way to meet your financial needs. However, before you dive into the process, there are a few important factors that you should consider. In this article, we will discuss some key things to keep in mind before applying for an online loan. Interest Rates […]

When it comes to financial assistance, online loans have become a popular choice for many Filipinos. With the convenience and accessibility they offer, online loans provide a quick and efficient way to meet urgent financial needs. In the Philippines, there are several types of online loans available, each designed to cater to specific financial requirements. […]

Online loans have gained significant popularity in recent years, offering a convenient and accessible alternative to traditional lending institutions. These digital platforms provide borrowers with quick approval processes and cater to individuals who may not have access to traditional banking services. However, like any financial product, online loans come with their own set of benefits […]

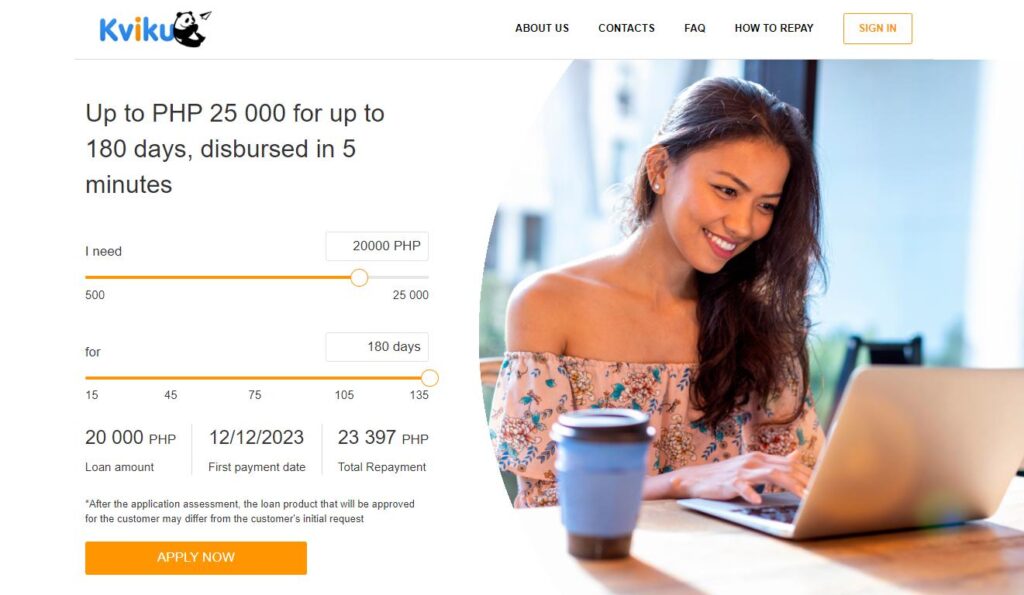

In the ever-evolving landscape of financial technology, the need for accessible and efficient loan services has led to the emergence of platforms like Kviku Loan in the Philippines. This comprehensive review aims to delve into the intricacies of Kviku’s offerings, exploring its legitimacy, application process, interest rates, and customer experiences. By providing an in-depth analysis, […]

Metrobank is one of the largest banks in the Philippines, offering a wide range of banking and financial services to its customers. One of the services offered by the bank is foreign exchange, which allows customers to exchange one currency for another. If you are interested in checking the Metrobank Dollar Exchange Rate today, there […]

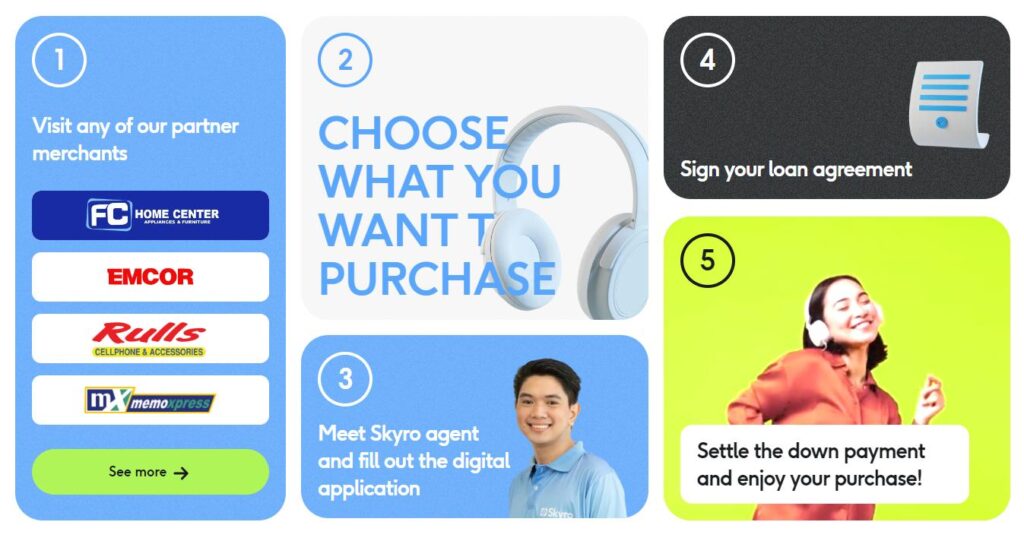

In an era marked by financial innovations and digital solutions, individuals seeking swift and accessible loans often turn to platforms like the Skyro Loan Review App. Promising a quick and hassle-free loan application process, Skyro has garnered attention in the Philippines. MrCashLoan PH aims to delve into the intricacies of Skyro Loan, offering a detailed […]

In the rapidly evolving landscape of financial technology, Lemon Loan emerges as a beacon, offering a comprehensive array of online cash loan services tailored to the unique needs of users in the Philippines. Distinguished by its integration of cutting-edge artificial intelligence (AI) technology and robust big data analytics, Lemon Loan has become synonymous with a […]

Best Quick Cash Loans in the Philippines: Legit and Fast. Apply fast loan in 15 minutes in the Philippines with 0 interest ☝ High approval rate ⚡ instant and easy application ✓ receive money you need.