In an era marked by financial innovations and digital solutions, individuals seeking swift and accessible loans often turn to platforms like the Skyro Loan Review App. Promising a quick and hassle-free loan application process, Skyro has garnered attention in the Philippines. MrCashLoan PH aims to delve into the intricacies of Skyro Loan, offering a detailed exploration of its legitimacy, requirements, application process, and payment methods.

Loan type

Short termFor a period of

728 daysRate ()

365.00% / yearLoan amount

25000 ₱Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

20000 ₱Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

25000 ₱Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

25000 ₱Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

25000 ₱Approval in

15 minutesFirst loan free

noSummary of Skyro Loan Review Philippines

At the heart of any comprehensive review lies a succinct summary. Skyro Loan Review: Good. These two words encapsulate the essence of the platform, indicating a positive assessment. Beyond this, the parameters of the loans offered are crucial for potential borrowers.

- Loan Parameters: Skyro provides a lending range from ₱5,000 to ₱250,000, with flexible repayment terms spanning 6, 9, or 12 months. The interest rates vary between 1.5% and 7% per month.

- Eligibility Criteria: The eligibility criteria encompass an age range of 18 to 70 years, with the compelling simplicity of requiring only one valid ID for application.

- Geographical Support: While its reach extends to Metro Manila, Skyro also caters to specific provinces, including Batangas, Bulacan, Rizal, Cavite, Laguna, and Cebu.

- Prospective Borrowers: The platform positions itself favorably by offering a high maximum loan amount, accommodating installment plans, and presenting a legitimate profile.

What is Skyro Finance?

To understand the core of Skyro, one must explore its origins and objectives. Skyro Finance is the brainchild of Advanced Finance Solutions, Inc. and Jungle Lending, Inc. Launched in 2022, this brand strives to redefine lending in the Philippines by offering point-of-sale (POS) and cash loans, designed to be both accessible and fair.

Types of Skyro Installment Loans

Diversity in loan offerings enhances the appeal of a lending platform. Skyro stands out by providing two primary types of installment loans:

Skyro Cash Loan

A versatile service allowing borrowers to secure cash up to ₱250,000 without the burden of collateral. The funds can be conveniently disbursed to the customer’s bank account or e-wallet.

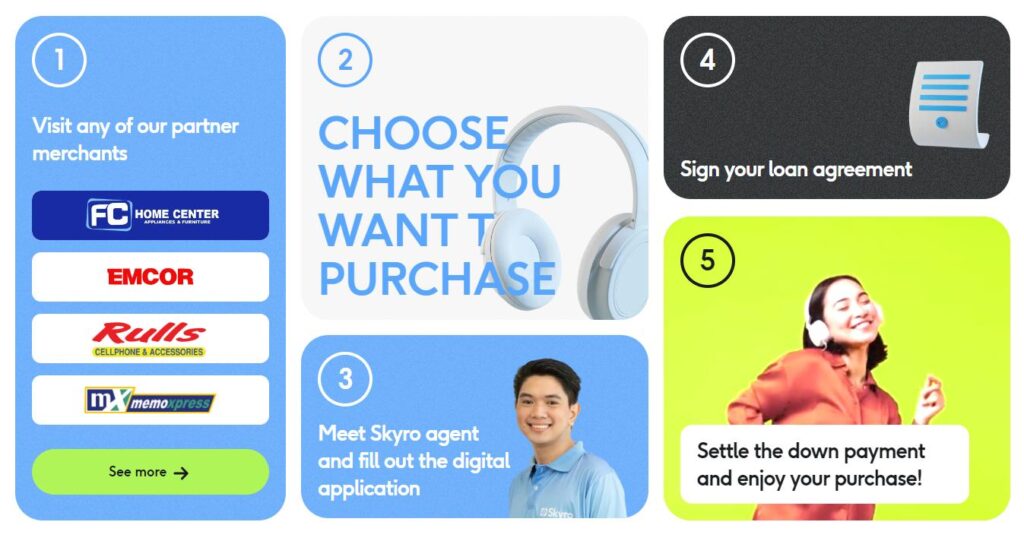

POS Loan

In addition to cash loans, Skyro facilitates point-of-sale (POS) loans, often referred to as Skyro gadget loans. This service empowers customers to make purchases of home appliances, electronics, or furniture from partner merchants. The appeal lies in the low down payment requirement and flexible monthly installments, with cellphone installment loans being a notable example.

Understanding Skyro Loan

What is Skyro Loan?

The essence of any loan service is encapsulated in its offerings and accessibility. Skyro Loan is positioned as a personal loan service, tailor-made for Filipinos seeking flexibility and convenience in financial solutions. The beauty of this service lies in its minimalistic requirements, mandating only one valid ID and a smartphone for application.

Pros of Skyro App

Every lending platform has its unique selling points, and Skyro is no exception. To assist potential borrowers in making informed decisions, let’s explore the advantages offered by Skyro Loan:

- Generous Loan Limits: Borrowers can access amounts up to ₱250,000, a figure that surpasses many competitors in the online lending space in the Philippines.

- Flexible Payment Options: Skyro empowers borrowers with the autonomy to choose between 6, 9, or 12-month repayment periods, aligning with individual preferences and budgets.

- Efficient Application Process: The simplicity of the application process is a notable feature. A single valid ID is the only prerequisite, eliminating the need for a plethora of documents or collateral.

- Customer-Centric Approach: A friendly customer service interface adds a human touch to the digital lending experience.

- Special Offers and Discounts: Skyro sweetens the deal by offering special promotions and discounts to its borrowers.

Cons of Skyro Lending

To present a balanced view, it’s imperative to highlight potential drawbacks. Prospective borrowers should be aware of the following considerations before committing to Skyro Cash Loan:

- Origination Fee: An origination fee, equivalent to 16.6% of the approved loan amount or ₱5,000, applies. The lower of the two values is charged.

- Late Payment Fee: A late payment fee of ₱500 or 5% of the loan disbursement amount is levied.

- Pre-payment Fee: For those seeking early loan repayment, a 5% fee is applicable.

- In-Person Meeting Requirement: Unlike fully digital processes, Skyro mandates an in-person meeting with a representative for the finalization of the contract.

Skyro Loan Requirements

Understanding the prerequisites for loan eligibility is fundamental for potential applicants. Skyro has established the following criteria:

- Citizenship and Age: Applicants must be Filipino citizens aged between 18 and 70 years.

- Geographic Accessibility: The ability to meet with a Skyro representative is necessary, either in Metro Manila or in selected provinces (Batangas, Bulacan, Rizal, Cavite, Laguna, Cebu).

- Technological Requirements: A smartphone and a Philippine mobile number are prerequisites for application.

- Valid Government ID: A single valid government ID is mandatory, and acceptable options include a Philippine passport, PhilSys ID, driver’s license, UMID, SSS ID, Postal ID, or PRC ID.

- Income Documentation: Providing proof of income from reliable sources such as employment, business, pension, or remittances is part of the application process.

Skyro Loan Interest Rate

A crucial factor in any borrowing decision is the interest rate imposed. Skyro distinguishes itself by offering a competitive interest rate ranging from 1.5% to 7% per month. The variation in rates is influenced by factors such as the loan amount, term, and the applicant’s credit score.

Example of Skyro Loan Calculator

Transparency in loan terms is essential for borrowers to make informed decisions. Skyro facilitates this through its loan calculator, allowing applicants to estimate monthly payments based on the loan amount and installment period.

Let’s consider a hypothetical scenario: Borrowing ₱60,000 for 12 months with an interest rate of 1.5%. The monthly payment, as per the estimate, would be ₱5,960. It’s crucial to note that this is an illustrative example, and actual amounts may vary based on prevailing rates during the application.

Applying for Skyro Loan

Skyro provides a step-by-step guide to applying for a loan:

- Visit the Website or Download the App: The journey begins with accessing the Skyro website (skyro.ph) or downloading the mobile app available for Android and iOS.

- Utilize the Loan Calculator: Applicants can use the loan calculator on the website or app to determine the loan amount and installment period that aligns with their financial needs. This step provides insights into the monthly payment and interest rate associated with the chosen parameters.

- Fill Out the Online Form: Clicking on “Apply for this loan” initiates the online form, where applicants provide personal details such as full name, mobile number, and email address.

- Confirm Phone Number: An essential security measure involves entering an SMS code sent to the registered mobile number.

- Upload ID and Provide Additional Information: Applicants are required to furnish information about their income source and bank account or e-wallet. Additionally, a photo of the valid ID, showcasing the current address and date of birth, must be uploaded.

- Schedule a Meeting: The final step in the online form involves selecting the date, time, and place for a meeting with a Skyro representative.

- Meeting with the Representative: After form submission, a Skyro agent contacts the applicant to confirm the meeting details. The representative typically meets with the applicant within 1 to 5 days after the application.

- Signing the Contract: On the scheduled day, applicants meet with the representative to sign the loan documents. This process typically takes 30 to 60 minutes.

- Final Approval and Fund Disbursement: Post-meeting, Skyro reviews the application and communicates the decision through a phone call or SMS. If approved, funds are credited to the bank account or e-wallet within 1 to 8 days.

Skyro Loan Review and Feedback

Gaining insights from users who have traversed the loan process is invaluable. A personal review from MrCashLoanPH, who utilized Skyro for a ₱50,000 loan to purchase a new laptop, provides real-world feedback.

MrCashLoanPH’s Experience: “After using Skyro for three months, I am pleased with the application process. I needed a loan to buy a new laptop for my online business, and Skyro made it easy. I only had to upload one valid ID and schedule a meeting with a Skyro representative. The representative visited my house the next day, explained the loan terms, and I received the money in my bank account within an hour. The interest rate for my loan was 2% per month, which is reasonable. Skyro offers flexible payment options, and I appreciate the timely payment reminders and friendly customer service. Overall, I am satisfied with the Skyro loan app and would recommend it to anyone in need of quick and easy cash.”

User Feedback: Positive feedback from numerous customers further solidifies the positive reputation of Skyro. This positive sentiment is visually represented through shared images of satisfied customers, creating a sense of trust and reliability.

How to Make Skyro Loan Payment

Understanding the repayment process is integral to ensuring a smooth borrower experience. Skyro outlines a straightforward process for loan repayment:

- Access the Loan Details: On the home screen of the Skyro app, locate the block with your loan details.

- Initiate Payment: Tap on “Make a payment” to commence the repayment process.

- Payment Options: Choose the preferred payment method and follow the on-screen instructions. Skyro offers three payment options:

- Bank Transfer: Utilize online banking apps or websites to transfer the payment amount to Skyro’s bank account. Partner banks include BDO, BPI, Land Bank, Metrobank, RCBC, and UnionBank.

- E-wallet: Make payments using GCash, PayMaya, GrabPay, or Coins.ph. Users can scan the QR code within the Skyro app or input their mobile number and the payment amount.

- Over-the-Counter Outlets (OTC): Generate a code within the Skyro app and present it to the cashier at designated outlets. A list of OTC partners and their locations can be found on the company website.

- Confirmation Awaited: After making the payment, users are advised to wait for the confirmation message from Skyro. The processing time may vary, with a potential wait of up to 48 hours, contingent on the processing speed of the chosen bank, e-wallet, or OTC outlet.

- Transaction Fees: It’s imperative to note that a ₱25 transaction fee applies to payments via e-wallet or over-the-counter partners. For online bank payments, the transaction fee comprises ₱25 along with an additional fee ranging from ₱10 to ₱25.

Compare Skyro Financing to Home Credit and Other Apps

For individuals navigating the lending landscape, a comparative analysis aids in making an informed choice. Let’s juxtapose Skyro Loan with other lending apps, notably Home Credit and Unacash, across various criteria:

Loan Comparison:

| Criteria | Skyro Loan | Home Credit | Unacash |

|---|---|---|---|

| Amount | ₱5,000 – ₱250,000 | ₱3,000 – ₱150,000 | ₱1,000 – ₱50,000 |

| Tenor | 6 – 9 – 12 months | 6 – 60 months | 2 – 6 months |

| Age | 18 – 70 years old | 18 – 68 years old | 18 and older |

| Interest rate | 1.5% – 7%/month | 1.83%/month or more | 0% – 16%/month |

| Approval time | 1 to 8 days | As fast as 1 minute | Less than 24 hours |

| General assessment | Good | Good | Middling |

This comparison provides a snapshot of the key differences among these lending platforms, highlighting Skyro’s strengths in terms of higher loan amounts, competitive interest rates, and reasonable approval times.

Skyro Loan Contact Number

Transparent communication channels contribute to customer satisfaction. Skyro ensures accessibility through various contact methods:

- Hotline Numbers: +63 919 170 0717 / +632 8540 3337

- Address: 20F Cyber Sigma, Lawton Avenue, Bonifacio South, Taguig City, 1637 Metro Manila.

- Website: skyro.ph

- Portal: portal.skyro.ph

- Email: [email protected]

- Twitter: twitter.com/skyroph

- Partnership: skyro.ph

FAQs – Frequently Asked Questions about Skyro App Philippines

Anticipating user queries and providing clear, concise answers is a hallmark of a user-friendly platform. Skyro addresses common questions to enhance user understanding:

Frequently Asked Questions:

How can I pay Skyro using GCash?

To pay your Skyro loan using GCash, follow these steps:

- Log in to your GCash app and tap on “Pay Bills.”

- Select “Loans” from the biller categories and choose Skyro as the biller.

- Enter your Skyro loan account number, the payment amount, and your email address.

- Confirm the details and tap on “Pay Now.”

- You will receive a confirmation message and an email receipt for your payment.

Is Skyro Loan a legitimate service?

Yes, Skyro Loan is a legitimate lending company operating in the Philippines. It is registered with the Securities and Exchange Commission (SEC), the government agency overseeing the lending industry. Additionally, it is a member of the Fintech Alliance of the Philippines (FinAccel), promoting ethical lending practices.

What is the processing time for Skyro loans?

The application process typically takes 30 to 60 minutes, excluding the time required for a meeting with a Skyro agent. Meetings can be scheduled within 1 to 8 days after completing the online form. The total processing time varies based on agent availability and customer schedules.

What is the penalty fee for Skyro loans?

The penalty fee is ₱500 or 5% of the disbursement amount, whichever is lower. This fee applies the day after your due date and every subsequent month you’re overdue. Timely payments through online banks, e-wallets, or over-the-counter outlets can help you avoid this penalty.

Is Skyro SEC registered?

Yes, Skyro is registered with the SEC under two corporations: Advanced Finance Solutions, Inc. (SEC Registration Number 2022080063542-00, License Number F-22-0029-37) and Jungle Lending, Inc. (SEC Registration Number CS202002223, License Number 3249).

Conclusion

Skyro Loan provides a convenient and reliable option for accessing loans in the Philippines. With minimal requirements, reasonable interest rates, and flexible payment methods, it offers a hassle-free and affordable solution for those seeking loans.