Are you in need of extra cash? In the Philippines, the process of obtaining a loan often involves meticulous submission of various requirements. However, there are numerous options available for those seeking quick and easy loan application processes, particularly for individuals who require immediate financial assistance or lack sufficient income documentation. Easy Loan Application: Where […]

Category Archives: Loans Philippines

Discover a diverse array of personal loan offers from major banks, all conveniently gathered in one location. Ensure a wise decision by selecting the option that aligns perfectly with your requirements. In this article, MrCashLoan PH navigates through the diverse offerings of the most prominent banks, providing you with a consolidated resource to make an […]

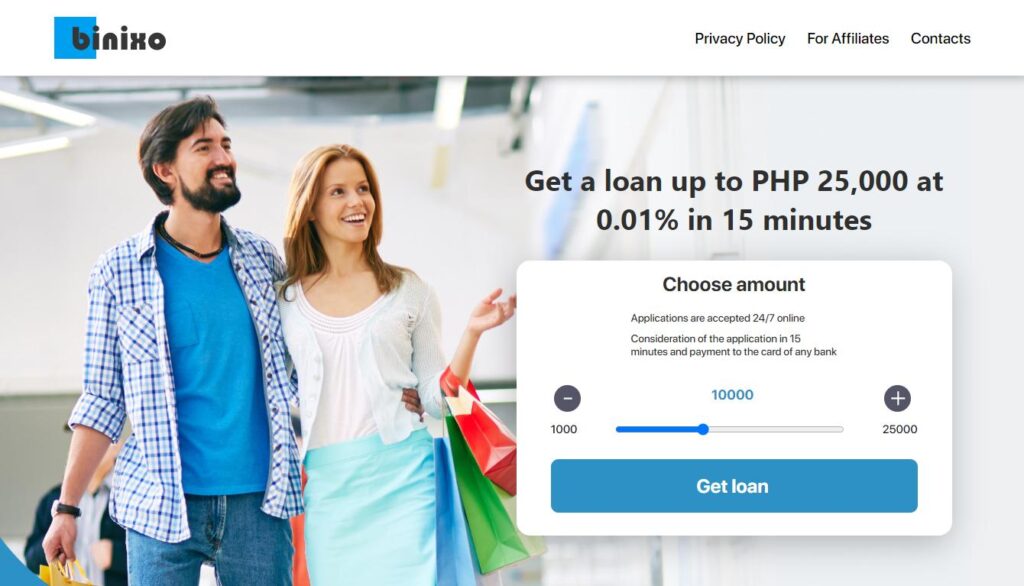

In the rapidly evolving landscape of financial services, Binixo Loans has emerged as a focal point, prominently featured on MrCashLoanPH as a distinguished online lending platform in the Philippines. This thorough review seeks to meticulously examine the legitimacy, registration status, and operational intricacies of Binixo Loans. APPLY BINIXO LOAN Binixo Loan Overview Binixo Loan Review […]

OKPeso positions itself as a swift and convenient online loan application, eliminating the need for collateral. Operated by Codeblock Lending Inc., a reputable financial institution registered with the Securities and Exchange Commission (SEC), it offers borrowers the opportunity to secure loans of up to ₱20,000 with a repayment window spanning from 96 to 365 days. […]

Foreign currency exchange rates are constantly in flux, making it imperative for individuals and businesses to stay informed of the most current rates. Development Bank of the Philippines (DBP) is one of the most major financial institutions in the country that provides a range of banking services, including foreign currency exchange. If you are keen […]

In today’s digital age, online lending has become increasingly popular due to its convenience and accessibility. However, with the convenience of online lending comes the responsibility of protecting personal information and ensuring data privacy and security. As borrowers, it is crucial to choose lenders with robust data privacy and security practices to safeguard our sensitive […]

Online lending has gained significant traction in the Philippines in recent years, and its future looks promising. With the increasing demand for quick and accessible financing options, the online lending industry is expected to continue its upward trajectory. However, as this industry expands, it becomes crucial to establish and enforce regulations that protect borrowers and […]

Online lending has revolutionized the way Filipinos access credit, providing them with easier and more convenient options than traditional lending institutions. However, this growing trend has also raised concerns about over-indebtedness and financial stability in the Philippine economy. The Convenience of Online Lending One of the key advantages of online lending is the convenience it […]

In the Philippines, the Securities and Exchange Commission (SEC) plays a crucial role in regulating the operations of online lending companies. With the rise of digital platforms offering quick and convenient loans, it has become imperative to establish guidelines and safeguards to protect borrowers from predatory lending practices. The SEC, as the primary regulatory body, […]

When faced with financial difficulties, many people turn to online loans as a quick solution. While these loans can provide immediate funds, they often come with high interest rates and fees that can trap borrowers in a cycle of debt. Fortunately, there are alternative options available that can help you meet your needs without resorting […]