Welcome to our comprehensive analysis of Digido, a prominent player in the online lending landscape in the Philippines. In this detailed exploration, we will delve into the legitimacy of the Digido app, available payment methods, the intricacies of the application process, interest rates, and user feedback. This exhaustive review aims to equip you with the requisite knowledge to make an informed decision should you consider availing yourself of a loan through Digido.

Loan type

Short termFor a period of

728 daysRate ()

365.00% / yearLoan amount

25000 ₱Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

20000 ₱Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

25000 ₱Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

25000 ₱Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

25000 ₱Approval in

15 minutesFirst loan free

noSummary of Digido Loan Review in the Philippines

Digido, positioned as a reputable online lending platform, boasts a license from the Securities and Exchange Commission (SEC) of the Philippines. This lends credibility to the platform, ensuring adherence to regulatory standards and transparent operations. Offering loans ranging from ₱1,000 to ₱25,000 with a flexible term of 7 to 180 days, Digido has established itself as a reliable choice for borrowers.

| ₱ Loan App | Digido Loan Philippines |

| ₱ Loan Amount | ₱1,000 to ₱25,000 |

| ₱ Flexible Term | 7 to 180 days |

| ₱ Interest Rate | 0% for first-time borrowers |

| ₱ Age Requirement | 21 – 70 years old |

| ₱ SEC Registration | SEC-registered loan app with SEC Registration No. CS202003056 Certificate of Authority No. 1272 |

| ₱ Payment Methods | GCash, 7-Eleven, and more |

| ₱ Contact Information | – Email: [email protected] |

| – Phone: (02) 8876-84-84 |

Why Choose DigiDo:

- Transparent Terms: We believe in clear communication. Our terms and conditions are straightforward, ensuring you understand every aspect of your loan.

- Zero Interest for First-Time Borrowers: As a first-time borrower, enjoy the benefit of a 0% interest rate on your initial loan with DigiDo.

- SEC-Registered: Your trust is our priority. We are a SEC-registered loan app, providing you with the assurance of a legitimate and regulated lending platform.

- Flexible Repayment: Choose a loan term that suits your financial situation. Whether you need a short-term loan or a more extended repayment period, we’ve got you covered.

- Diverse Payment Options: We understand the importance of convenience. Make repayments hassle-free with various payment methods, including GCash, 7-Eleven, and more.

What is Digido Loan Philippines?

Digido emerges as a digital lending platform providing swift access to loans up to ₱25,000 in the Philippines. Holding a license from the SEC, Digido leverages Fintech technology to facilitate quick and secure loan processing. The application process is streamlined, requiring only a valid ID, and funds are credited to the borrower’s account within hours. The platform prides itself on offering flexible repayment terms, ranging from 3 to 6 months.

Advantages of Digido App

Digido’s user-friendly features and advantages position it as a preferred choice among borrowers in the Philippines:

- Transparent Charges: Users are assured of no hidden fees or commissions.

- Accessibility: The platform is available 24/7, allowing for anytime loan applications.

- Efficiency: Quick approval with an impressive 90% acceptance rate.

- Versatility: Loans for various purposes without the need for collateral.

- Customer Rewards: Loyal customers benefit from improved terms.

- Flexibility: Loans are accessible even without a traditional bank account.

Disadvantages of Digido Online Loan

While Digido presents itself as a robust lending platform, potential drawbacks include:

- Short Repayment Terms: The platform limits loan terms to a maximum of 180 days.

- Loan Amount Limit: Borrowers are capped at a maximum loan amount of ₱25,000.

- Interest Rates: Rates are relatively higher compared to traditional banking institutions.

Digido Loan Requirements

Eligibility Criteria

To be eligible for a Digido loan, applicants must meet specific criteria:

- Be Filipino citizens residing in the Philippines.

- Fall within the age range of 21 to 70.

- Possess a valid mobile number.

- Hold at least one of the accepted IDs (Passport, Driver’s license, UMID, SSS ID, National ID, TIN ID).

Application Process

- First Loan: Requires a photo ID and a selfie for identity verification.

- Reloan: Subsequent loans may not necessitate additional documents.

- 3rd Loan: Offers lower interest rates and extended terms for repeat borrowers.

Digido Maximum Loan and Payment Terms

- First Loan: Up to ₱10,000 with a 0% interest rate.

- 2nd Loan: Higher amounts, up to ₱25,000.

- Payment Terms: Flexibility tailored to the borrower’s financial needs.

Digido Loan Interest Rate

- Special Offer: First-time borrowers enjoy a 0% interest rate for the initial seven days.

- Regular Rates: Subsequent loans vary based on the amount and duration but do not exceed 1.5% per day.

Digido Loan Interest Rate Calculator

For a clearer understanding, let’s illustrate loan calculations using a hypothetical scenario:

Suppose a borrower wishes to acquire ₱12,000 from the Digido loan app for a term of 4 months with a daily interest rate of 0.3%. The monthly breakdown is as follows:

- Daily Interest: ₱12,000 x 0.3% = ₱36

- Monthly Interest: ₱36 x 30 = ₱1,080

- Total Interest: ₱1,080 x 4 = ₱4,320

- Total Repayment: ₱12,000 + ₱4,320 = ₱16,320

- Monthly Payment: ₱16,320 / 4 = ₱4,080

In this scenario, the borrower would make monthly payments of ₱4,080 for the loan.

Guide to Register for Digido Loan Application

Applying for a Digido online loan is a straightforward process, involving four key steps:

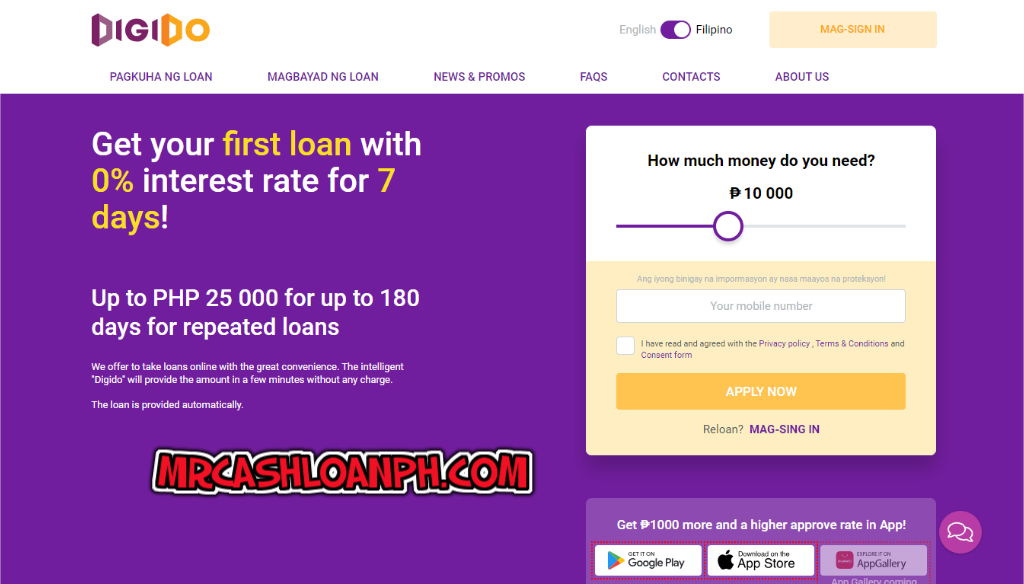

Step 1: Choose the Loan Amount

- Visit the Digido website’s homepage: digido.ph or VISIT LINK HERE

- Select the desired loan amount.

- Enter your phone number, check terms and conditions, and click “Apply Now.”

Step 2: Confirm Phone Number

- Digido will send an OTP code for verification.

- Enter the code and agree to the terms to proceed.

Step 3: Fill in Personal Information

- Provide personal details, including name, date of birth, email, ID number, job information, and bank account details.

- Opt for GCash disbursement if preferred.

- Upload a photo of your ID for verification.

Step 4: Wait for Approval

- Digido processes applications within 5 minutes.

- Approval results are communicated promptly.

- If approved, funds are disbursed the same day.

Additionally, a video guide is available for applicants, ensuring a smooth application process.

Digido Loan Review and Feedback

Sharing a personal experience, a user recounts their need for extra funds to cover a medical emergency. The user found the Digido application process impressively easy, involving app download, basic information input, ID photo upload, and submission. Approval and loan offer confirmation were received within 15 minutes, leading to a successful loan of ₱25,000 for 10 days at an interest rate of 1.5% per day. The total repayment of ₱23,000 was considered reasonable for the short-term loan. The user praised Digido’s customer service for reminders and notifications about due dates and balances, expressing overall satisfaction.

Digido Repayment

Digido Philippines facilitates convenient repayment through various methods:

- Payment Centers: 7-Eleven, ECPay, or TrueMoney outlets.

- Cebuana Lhuillier or Bayad Center: In-person branches.

- Online Payment: GCash, Coins.ph, Dragonpay, and other online platforms.

Late Payment

Late payment incurs penalties, and Digido sends reminders to users. It’s crucial to settle payments promptly to avoid additional charges.

Unpaid Loan

For borrowers facing difficulties, Digido offers the “pay part” extension service, allowing payment of a portion of the loan to extend the due date. Communicating with customer service to explore tailored solutions is encouraged for those with unpaid loans.

How to Contact Digido Customer Service

Digido ensures multiple channels for customer support:

- Email: [email protected]

- Phone: (02) 8876-84-84

- Live Chat: Available on the Digido website.

Prompt and effective customer service is vital for addressing concerns or queries.

FAQs – Digido Loan Review in the Philippines

For your convenience, we have assembled a set of frequently asked questions regarding the Digido loan app, along with comprehensive answers:

Is Digido SEC registered?

Certainly. Digido Philippines holds a valid SEC Registration No. CS202003056. This assures that the company operates legitimately, adhering to the regulations set by the Securities and Exchange Commission of the Philippines. It also signifies Digido’s commitment to safeguarding the rights and interests of its customers and partners. To verify this information, please visit the SEC website.

How can I delete my Digido account?

If you wish to delete your Digido loan account, immediate deletion may not be possible. Your account will be retained for 5 years after your last loan repayment. However, to cease receiving notifications from the Digido app, you can unsubscribe from emails and SMS messages by following the instructions provided in their communications.

Does Digido contact my contacts?

No, Digido respects your privacy and refrains from contacting your associates unless there is a failure to repay the loan on time.

Does Digido conduct field visits?

No, Digido operates exclusively as an online lending platform. You can apply for a loan from anywhere in the Philippines, provided you have a valid ID, a bank account, and a stable income source. Digido PH does not engage in home visits or unsolicited calls or texts.

Is Digido a loan shark?

Digido is not a loan shark. The company offers loans with reasonable interest rates and flexible repayment terms. Additionally, the Digido loan app provides financial education and guidance to assist borrowers in enhancing their credit scores and overall financial well-being.

How can I change my bank account information in Digido?

- Log in to your Digido loan account using your email and password.

- Navigate to the “Profile” section and click on the “Bank Account” tab.

- Input your new bank account details and click on the “Save Changes” button.

- You will receive a confirmation email from the app containing a verification code.

- Enter the verification code in the Digido app to complete the bank account change process.

Conclusion – Should You Apply for a Digido Loan Online in the Philippines?

Digido stands out as a reliable online lending platform in the Philippines. Its SEC registration ensures legitimacy, and the platform’s features, including transparent charges, efficiency, and customer rewards, make it an attractive option. While limitations like short repayment terms and a maximum loan amount exist, Digido’s benefits often outweigh these drawbacks.

If you are in need of a quick, accessible, and transparent lending solution, Digido may be a suitable choice. However, as with any financial decision, it’s crucial to carefully consider your financial situation and the terms of the loan before proceeding. Always read and understand the terms and conditions, and ensure that the loan aligns with your financial goals and capabilities.