In the ever-evolving landscape of financial technology, the need for accessible and efficient loan services has led to the emergence of platforms like Kviku Loan in the Philippines. This comprehensive review aims to delve into the intricacies of Kviku’s offerings, exploring its legitimacy, application process, interest rates, and customer experiences. By providing an in-depth analysis, this review aims to empower potential borrowers with the knowledge needed to make informed financial decisions.

Loan type

Short termFor a period of

728 daysRate ()

365.00% / yearLoan amount

25000 ₱Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

20000 ₱Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

25000 ₱Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

25000 ₱Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

25000 ₱Approval in

15 minutesFirst loan free

noSummary of Kviku Loan Review

- Loan Limit: ₱1,000 – ₱25,000

- Interest Rate: 0.16%/day

- Term: Up to 180 days

- Age Requirement: 20 – 55 years old

- Geographic Coverage: Nationwide Philippines

- Advantage: Legitimate financial platform

- Efficiency Rating: Good

- Contact Number: +632 8877-8888

- Link Apply Kviku Loan Philippines

Kviku Group Overview

Kviku Group, a global online bank, has expanded its reach to the Philippines, offering instant lending solutions. As a part of Kviku Holding Ltd., the parent company, it not only provides loans but also offers virtual credit cards, buy-now-pay-later options, and installment loans. Kviku Finance, an integral part of the group, allows investors to engage in consumer loans, promising attractive returns.

What is Kviku Loan?

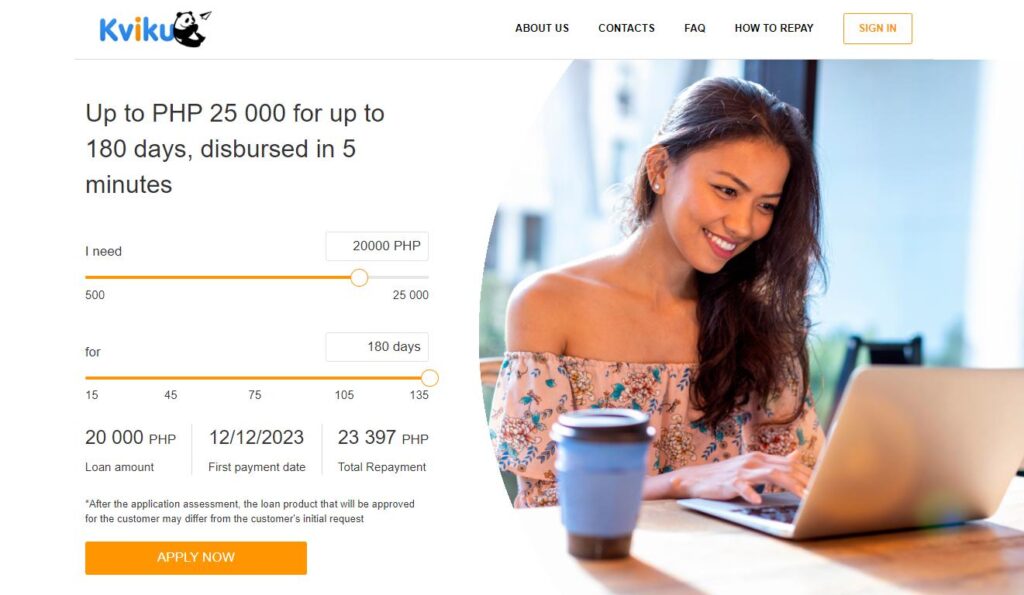

Kviku Loan is an online platform facilitating quick and accessible cash loans in the Philippines. With a maximum loan amount of ₱25,000 and a repayment period of up to 180 days, the platform promises a streamlined application process. The prerequisites are minimal – a valid government ID, an active phone number, and a designated bank account. Importantly, the platform prides itself on transparent interest rates and the absence of hidden fees. Repayment can be conveniently done online through payment cards or bank transfers.

Pros and Cons

Pros:

- Seamless Application Process: Users can apply online without the need to visit physical branches, simplifying the application process.

- Swift Approval and Disbursement: Approval can occur in as little as 15 minutes, with funds reaching the borrower’s account within 24 hours.

- Transparent Fee Structure: Kviku boasts a fee structure devoid of hidden charges or penalties for early repayment.

- High-Level Security: The platform employs advanced encryption and verification technologies to ensure the security and privacy of user data and transactions.

- Professional Customer Service: Customer service is available 24/7 through phone, email, or chat, offering a responsive and user-friendly support system.

Cons:

- Short Repayment Term: The 180-day repayment term may be limiting for some borrowers.

- Moderate Loan Amounts: The maximum loan amount might not be sufficient to cover all financial needs.

- No Support for Bad Debt Lending: The platform does not provide support for bad debt lending, limiting options for certain borrowers.

Kviku Loan Requirements

To apply for a Kviku loan, applicants must meet specific conditions:

- Be a Filipino citizen aged 20 to 55.

- Possess a valid government ID.

- Have an active phone number capable of receiving and sending messages.

- Maintain a bank account for loan disbursement.

- Additional documents, such as Payslip, ITR, or COE (for employed individuals) or DTI (for self-employed or business owners), can enhance approval chances.

Interest Rate and Special Offers

Kviku Philippines offers a competitive daily interest rate of 0.16%. Additionally, new customers can benefit from a special offer, allowing them to secure their first loan with a 0% interest rate for the initial 14 days, with a maximum loan amount of ₱5,000.

Example of Kviku Loan Calculator

Let’s illustrate the loan repayment using a hypothetical scenario: A borrower needs ₱10,000 for an urgent expense, intending to repay it over 180 days with an interest rate of 0.16% per day. The total monthly payment would be calculated as follows: Total interest for 1 month=16×30=480 pesos. Total monthly payment=(10,0006)+480=2,147 pesos. Additionally, Kviku provides an online calculator on their website, allowing users to assess borrowing capacity and monthly payment projections.

Step-by-Step Guide to Register on Kviku Loan App

The application process involves several steps:

Step #1: Choose the Amount and Term

Users select the loan amount and repayment period on the Kviku online bank’s website.

Step #2: Fill Out the Application

Personal information, including name, gender, date of birth, email address, SSS number, and phone number, is entered.

Step #3: Confirmation Number

Users confirm their phone number by entering the verification code sent via SMS, enhancing identity verification and preventing fraud.

Step #4: Transfer Money

Bank account details are provided for fund disbursement, with the company processing the application and transferring funds within 15 minutes.

Step #5: Track Loan Information

Users can monitor their loan information on the website or app, checking balances, repayment schedules, and interest rates. Customer service is also available for queries.

User Experience and Feedback

A user shares their experience after using Kviku’s service for a month. Applying for a ₱10,000 loan to cover their daughter’s tuition, the user highlights a fast and straightforward application process, quick fund disbursement, hassle-free repayment, and positive interactions with customer service. Visual feedback from satisfied customers further reinforces the reliability of the platform.

How to Make Kviku Loan Repayment

Kviku offers three convenient repayment methods:

- E-Wallets: Users can utilize Gcash, PayMaya, or Coins.ph for payments by selecting Kviku as the biller and confirming the transaction.

- Over the Counter: Payment can be made at 7-Eleven, Cebuana Lhuillier, M Lhuillier, or Bayad Center branches by presenting the lifetime ID and payment amount.

- Banks: Repayment through UnionBank via deposit or online banking is an option. Essential details, including bank name, Swift code, account number, and reference number, must be provided.

To avoid late fees and harassment, timely repayment is emphasized.

Compare Kviku Philippines to Other Online Loan Apps

A comparative analysis with other online loan apps, including Credify and OKPeso, sheds light on Kviku’s strengths, such as competitive interest rates, a high approval rate, and a positive general assessment.

| Criteria | Kviku | Credify | OKPeso |

|---|---|---|---|

| Maximum Loan Amount | ₱1,000 – ₱25,000 | ₱1,000 – ₱25,000 | ₱2,000 – ₱20,000 |

| Loan Term | Up to 180 days | 90 – 360 days | 96 – 365 days |

| Age Requirements | 20 – 55 years old | 20 – 70 years old | 18 – 49 years old |

| Interest Rate | 0.16% per day | Up to 15% per month | 24% per year |

| Approval Rate | 85% | 85% | 80% |

| General Assessment | Good | Good | Middling |

Contact Information

For queries or support, Kviku Lending Co Inc. can be reached through various channels, including hotline, email, and social media.

- Company: Kviku Lending Co Inc.

- Location: 18A Trafalgar Plaza, 105 H.V. Dela Costa Street, Salcedo Village, Makati City, Philippines.

- Hotline: +632 8877-8888

- Email: [email protected]

- Website: kviku.ph

- Facebook: facebook.com/KvikuBankPH

FAQs – Kviku Loan Review in the Philippines

Is Kviku Loan Legitimate?

Yes, Kviku Loan is a legitimate online lending platform in the Philippines. The company is officially registered with the Securities and Exchange Commission (SEC) under Registration No. CS201918702. Additionally, it holds a Certificate of Authority No. 3169 from the SEC, allowing it to operate as a financing company. Kviku is also registered with the National Privacy Commission (NPC) under Registration No. PIC-001-791-2021, demonstrating compliance with the Data Privacy Act of 2012.

How to Make Payments Using GCash?

To make payments using GCash for Kviku Loan, follow these steps:

- Open your GCash app and select “Pay Bills.”

- Choose “Loans” as the biller category and select “DragonLoans” as the biller name.

- Enter your Lifetime ID (found in your Kviku account) as the account number.

- Specify the amount you want to pay and confirm the transaction.

- You will receive a confirmation message from GCash and Kviku once the payment is successful.

Is Kviku SEC Registered?

Yes, Kviku is a duly registered corporation with the Securities and Exchange Commission (SEC) of the Philippines. You can verify their SEC Registration No. CS201918702 on the SEC website.

How to Cancel a Kviku Loan?

You have two options based on your application status:

- If you haven’t confirmed the contract, send an email to [email protected] to request cancellation.

- If you’ve already confirmed the contract, the money will be transferred to your account, and cancellation is not possible. However, you can repay the loan early with minimal interest. Contact Kviku Philippines customer service or check your profile on their website to determine the amount to pay.

Conclusion

The Kviku Loan Review Philippines showcases the platform’s high approval rate, competitive interest rate of 0.16% per day, and a user-friendly and secure registration process. The hope is that this comprehensive guide proves helpful and informative. Readers are encouraged to rate this article and share it with those in need of reliable loan options in the Philippines. If there are any further questions or concerns, the comment section is open for engagement.