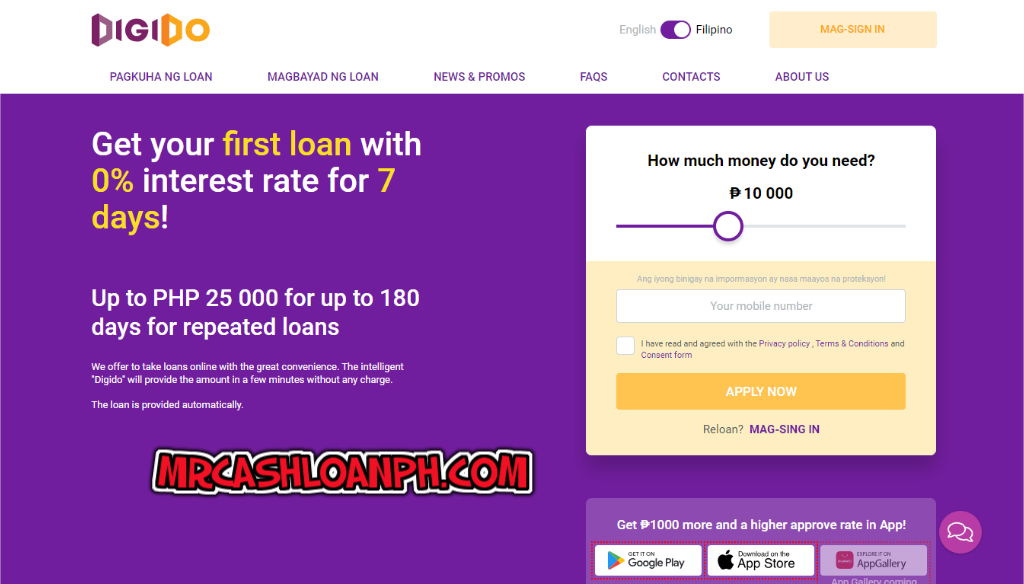

Welcome to our comprehensive analysis of Digido, a prominent player in the online lending landscape in the Philippines. In this detailed exploration, we will delve into the legitimacy of the Digido app, available payment methods, the intricacies of the application process, interest rates, and user feedback. This exhaustive review aims to equip you with the […]

Category Archives: Loans Philippines

In today’s digital age, finding the right online loan app in the Philippines has become easier and more convenient. These loan platforms offer flexible terms, fast approval, and a range of features designed to meet the diverse financial needs of Filipinos. If you’re looking for reliable, legit loan apps with long-term payment options, this guide […]

In the Philippines, the Securities and Exchange Commission (SEC) plays a crucial role in regulating the operations of online lending companies. With the rise of digital platforms offering quick and convenient loans, it has become imperative to establish guidelines and safeguards to protect borrowers from predatory lending practices. The SEC, as the primary regulatory body, […]

Follow these detailed steps to apply for an SSS loan through Cebuana Lhuillier: Step 1: Sign in to My.SSS Visit the official SSS website and log in to your My.SSS account. If you don’t have an account, create one. Step 2: Navigate to the Loan Application Section Once logged in, browse through the website to […]

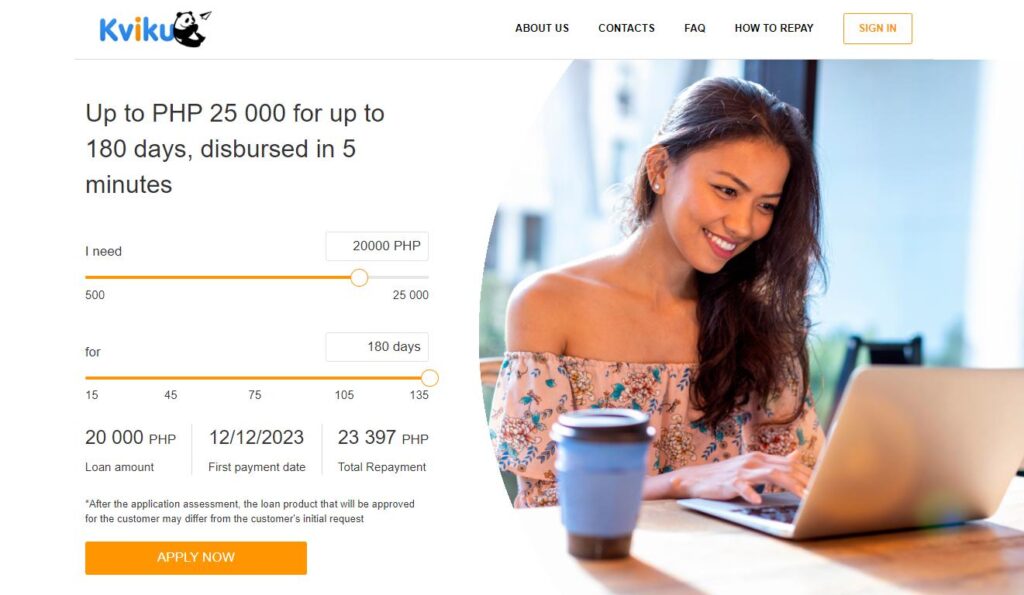

In the ever-evolving landscape of financial technology, the need for accessible and efficient loan services has led to the emergence of platforms like Kviku Loan in the Philippines. This comprehensive review aims to delve into the intricacies of Kviku’s offerings, exploring its legitimacy, application process, interest rates, and customer experiences. By providing an in-depth analysis, […]

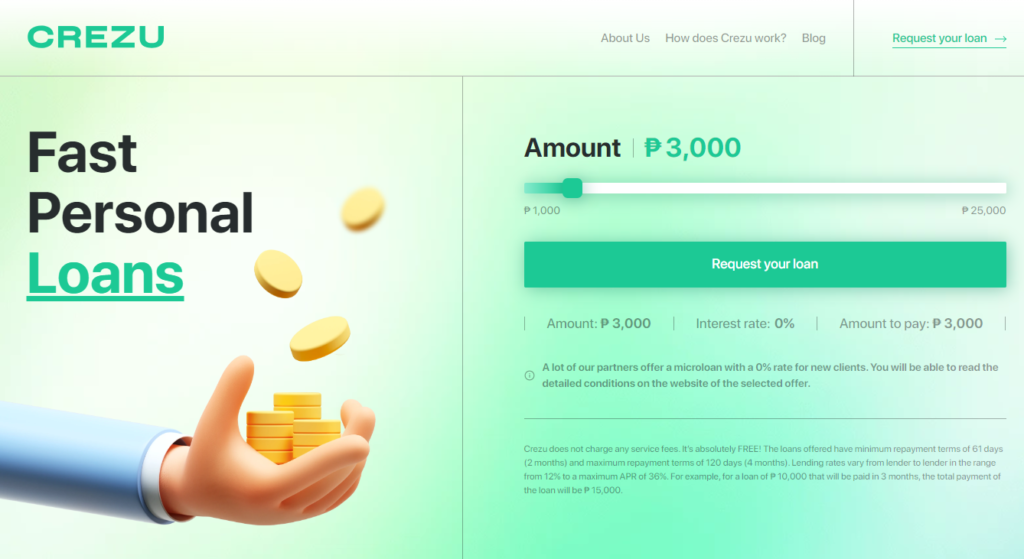

Discover comprehensive information about Crezu loan in the Philippines through this review. Learn about its functionality, advantages, requirements, interest rates, and the process of applying for and repaying a loan within the app. Additionally, MrCashLoanPH will address the legitimacy of Crezu loan. Continue reading to find answers to these questions and more. APPLY CREZU LOAN […]

Online loans in the Philippines have gained popularity as a convenient and hassle-free way to access fast cash. These loans can be applied for directly online, eliminating the need to visit a lender’s physical office. The entire application process, from communication to fund transfer, is conducted online. While online loans offer quick approval and minimal […]

Full Name BDO Unibank, Inc. Short Name BDO Date of First Business Registration January 2, 1968 Address 7899 Makati Avenue, Makati City 0726, Philippines Phone Customer Contact Center at 631-8000, Domestic Toll-free 1-800-10-6318000, and 1-800-3-6318000 (Digitel), International Toll-Free (IAC) + 800-8-6318000 Email [email protected] Website www.bdo.com.ph Facebook https://www.facebook.com/BDOUnibank BDO Unibank, Inc., commonly known as BDO, […]

When it comes to financial assistance, online loans have become a popular choice for many Filipinos. With the convenience and accessibility they offer, online loans provide a quick and efficient way to meet urgent financial needs. In the Philippines, there are several types of online loans available, each designed to cater to specific financial requirements. […]

Applying for an online loan in the Philippines has become a convenient option for many individuals who are in need of financial assistance. Whether it’s for emergency expenses, debt consolidation, or funding a business venture, online loans offer a quick and accessible solution. In this article, we will guide you through the process of applying […]