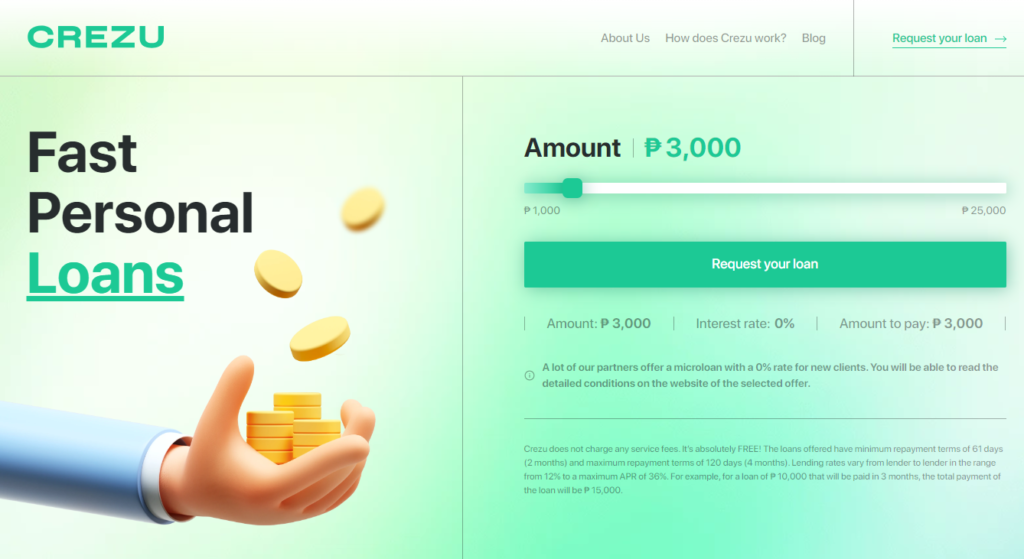

Discover comprehensive information about Crezu loan in the Philippines through this review. Learn about its functionality, advantages, requirements, interest rates, and the process of applying for and repaying a loan within the app. Additionally, MrCashLoanPH will address the legitimacy of Crezu loan. Continue reading to find answers to these questions and more. APPLY CREZU LOAN […]

Tag Archives: online loan

Applying for an online loan in the Philippines has become a convenient option for many individuals who are in need of financial assistance. Whether it’s for emergency expenses, debt consolidation, or funding a business venture, online loans offer a quick and accessible solution. In this article, we will guide you through the process of applying […]

In the ever-evolving realm of online financial services, the Philippines has witnessed a surge in the popularity of online loan applications. We will delves into the intricacies of the top 10 legit online loan apps, unraveling their features, interest rates, and application processes. As the demand for accessible and swift financial solutions rises, navigating the […]

In the dynamic landscape of financial solutions, the emergence of 0 interest loan apps in the Philippines is revolutionizing how individuals access credit. This comprehensive guide aims to delve deeper into the intricacies of these applications, shedding light on eligibility criteria, benefits, drawbacks, and an exhaustive review of the top 5 apps available in . […]

In the Philippines, loan apps have become increasingly popular as they provide easy access to borrowing money through smartphones. This article aims to guide Filipinos in choosing the best online loan app that meets their financial needs. We will discuss important factors to consider, such as legality, eligibility requirements, loan terms, interest rates, security measures, […]

Applying for an online loan can be a convenient and efficient way to meet your financial needs. However, before you dive into the process, there are a few important factors that you should consider. In this article, we will discuss some key things to keep in mind before applying for an online loan. Interest Rates […]

Welcome to our comprehensive review of the Cashspace loan app in the Philippines. In this article, we will provide you with a detailed overview of this online lending platform, its features, eligibility criteria, interest rates, application process, payment methods, and valuable advice. We aim to equip you with all the necessary information to make an […]

In the bustling financial landscape of the Philippines, Online Loans Pilipinas, commonly known as OLP, stands out as a prominent online lending platform. In this article, we will explore the legitimacy of OLP, the intricacies of the loan application process, the loan terms and interest rates, the required documentation, and the numerous advantages and potential […]

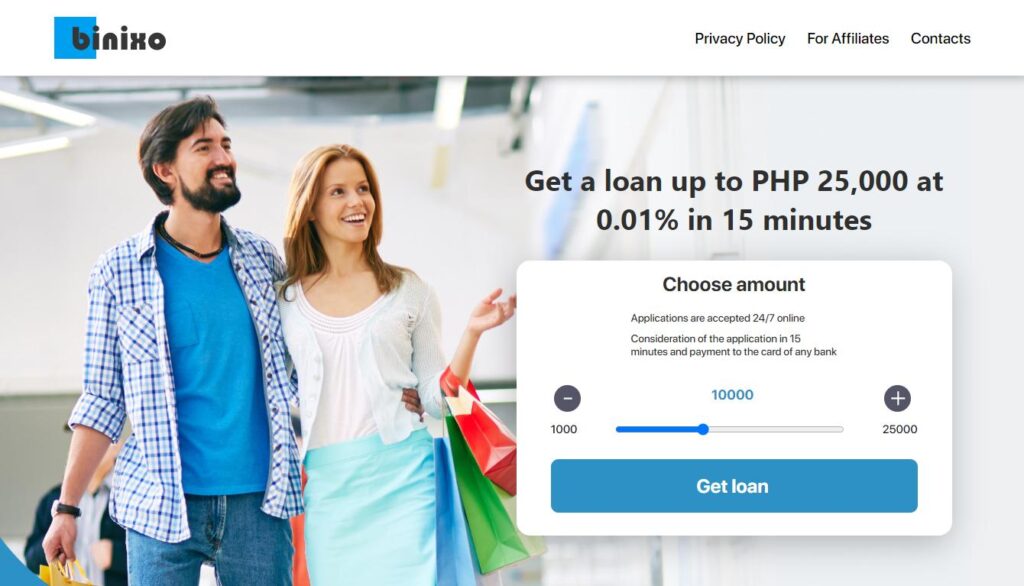

In the rapidly evolving landscape of financial services, Binixo Loans has emerged as a focal point, prominently featured on MrCashLoanPH as a distinguished online lending platform in the Philippines. This thorough review seeks to meticulously examine the legitimacy, registration status, and operational intricacies of Binixo Loans. APPLY BINIXO LOAN Binixo Loan Overview Binixo Loan Review […]

In an ever-changing financial world, where the cost of living continues to rise and financial stability often seems out of reach, the need for quick and accessible cash solutions has never been more critical. Money-related problems can affect anyone, regardless of their background or circumstances. In such situations, turning to family or friends for financial […]

- 1

- 2