In the ever-evolving landscape of financial services, online lending platforms have become integral to meeting the diverse needs of individuals and businesses. Kviku, a prominent player in this domain, has garnered attention for its commitment to providing fast, convenient, and flexible financial solutions. In this article, MrCashLoan PH will delve into the various facets of […]

Author Archives: mr.cash loan

BDO Unibank, Inc. (BDO) is a full-service universal bank in the Philippines. The bank provides a wide array of products and services, including foreign exchange, to cater to the needs of its customers. As such, if you are looking for a way to check the BDO exchange rate today in the Philippines, there are several […]

In the fast-paced digital age of , online cash loans have emerged as a popular financial tool in the Philippines, providing a quick and efficient means of accessing funds to cover various expenses. In this examination, MrCash Loan will explore the world of online cash loans in the Philippines. We’ll delve into their advantages, disadvantages, […]

You don’t have to seek the advice of financial experts just to identify the top quick cash loans available in . Numerous lending companies in the Philippines are offering competitive loan deals accessible to everyone. All you need to do to make sure you select the most suitable one is to peruse reliable online loan […]

Secured loans are a type of loan that requires collateral, such as a property or a vehicle, to secure the loan amount. This means that if the borrower fails to repay the loan, the lender can repossess the collateral to recover their losses. While secured loans offer certain advantages, they also come with a set […]

A personal loan can be a useful financial tool for many individuals. It provides quick access to funds that can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. However, like any financial product, there are also disadvantages to consider before taking out a personal loan. In this article, we […]

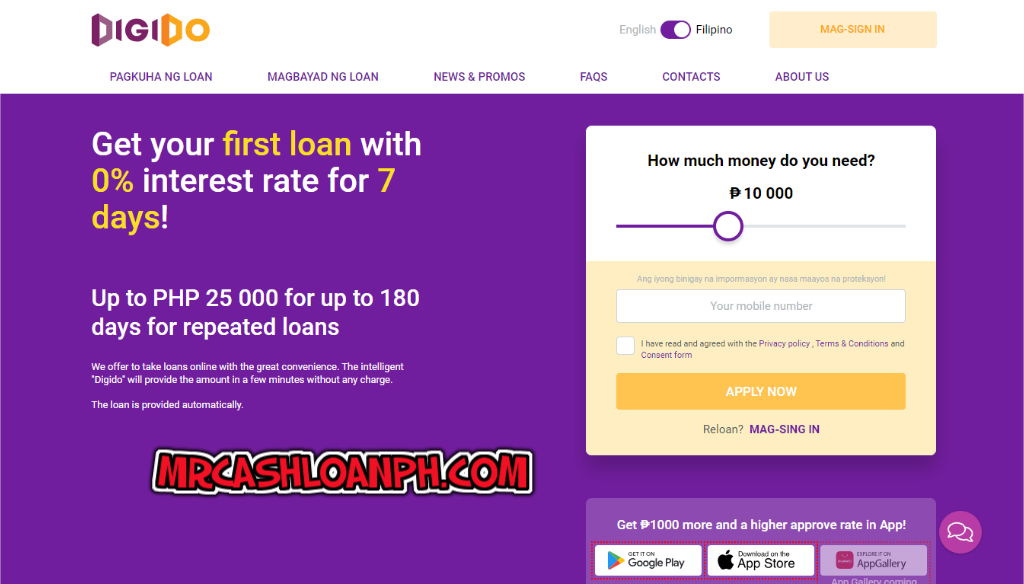

Welcome to our comprehensive analysis of Digido, a prominent player in the online lending landscape in the Philippines. In this detailed exploration, we will delve into the legitimacy of the Digido app, available payment methods, the intricacies of the application process, interest rates, and user feedback. This exhaustive review aims to equip you with the […]

In today’s digital age, finding the right online loan app in the Philippines has become easier and more convenient. These loan platforms offer flexible terms, fast approval, and a range of features designed to meet the diverse financial needs of Filipinos. If you’re looking for reliable, legit loan apps with long-term payment options, this guide […]

In the Philippines, the Securities and Exchange Commission (SEC) plays a crucial role in regulating the operations of online lending companies. With the rise of digital platforms offering quick and convenient loans, it has become imperative to establish guidelines and safeguards to protect borrowers from predatory lending practices. The SEC, as the primary regulatory body, […]

Follow these detailed steps to apply for an SSS loan through Cebuana Lhuillier: Step 1: Sign in to My.SSS Visit the official SSS website and log in to your My.SSS account. If you don’t have an account, create one. Step 2: Navigate to the Loan Application Section Once logged in, browse through the website to […]