When facing financial difficulties, it can be tempting to turn to loan sharks for quick and easy money. However, dealing with loan sharks can lead to a cycle of debt and financial instability. In the Philippines, where loan sharks are prevalent, it is important to be aware of the risks and take steps to avoid […]

Author Archives: mr.cash loan

In today’s digital age, online lending has become increasingly popular due to its convenience and accessibility. However, with the convenience of online lending comes the responsibility of protecting personal information and ensuring data privacy and security. As borrowers, it is crucial to choose lenders with robust data privacy and security practices to safeguard our sensitive […]

In an era of rapid technological advancements and changing financial landscapes, online loan applications have become increasingly popular, especially among Filipinos. MoneyCat, an emerging player in this field, has garnered attention for its ease of use and quick loan disbursement. In this MoneyCat review, we delve into the app’s key features, including its legitimacy, application […]

A personal loan is a type of loan that can be used for any purpose, such as consolidating debt, paying for a wedding, or funding a home renovation. Unlike specific loans like a mortgage or auto loan, a personal loan can provide you with the flexibility to use the funds as you see fit. In […]

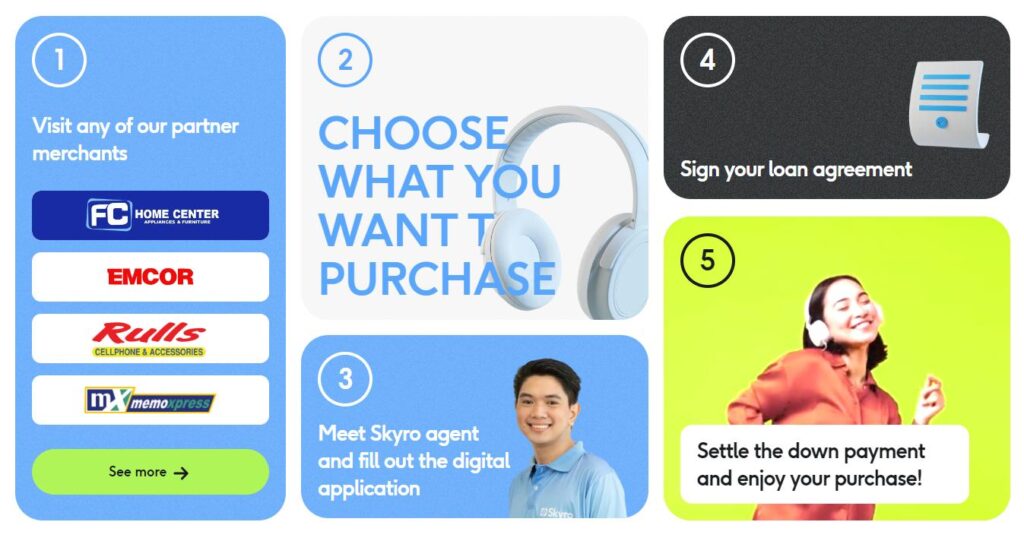

In an era marked by financial innovations and digital solutions, individuals seeking swift and accessible loans often turn to platforms like the Skyro Loan Review App. Promising a quick and hassle-free loan application process, Skyro has garnered attention in the Philippines. MrCashLoan PH aims to delve into the intricacies of Skyro Loan, offering a detailed […]

Mahirap na maghanap ng mga mapagkakatiwalaang lending companies sa Pilipinas, lalo na kung nais mong mag-apply para sa isang loan sa online platform. Mayroong maraming mga online lenders na nag-aalok ng mga mabilis na pautang sa internet, ngunit hindi lahat ay ligtas at maayos. Sa artikulong ito, tatalakayin natin kung paano makahanap ng mga reliable […]

MabilisCash emerges as a beacon of innovation, providing swift and reliable online lending solutions in the Philippines. This comprehensive review aims to delve into the intricacies of MabilisCash, shedding light on its features, benefits, and the overall experience it offers to users seeking efficient access to financial resources. Understanding MabilisCash MabilisCash is a cutting-edge online […]

Getting a loan can be a lifesaver in times of need. However, the traditional loan application process can be lengthy, complicated, and time-consuming. Fortunately, with the advancement of technology, applying for a loan has become more accessible and convenient. In the Philippines, online loans are becoming increasingly popular due to their fast and straightforward application […]

Online lending apps have witnessed a meteoric rise in popularity within the Philippines in recent years. These applications provide individuals with a convenient and rapid way to secure loans, effectively serving as a financial lifeline for those facing urgent monetary needs. However, the convenience offered by these apps is accompanied by several legal considerations that […]

Online loans have become increasingly popular in the Philippines in recent years. With the ease of accessibility and convenience, many Filipinos have turned to online lenders for their financial needs. However, as with any financial product, online loans come with both advantages and disadvantages. In this article, we will explore the pros and cons of […]