Are online loan apps legal in the Philippines? The answer is an unequivocal yes! The Philippine government has embraced the convenience and speed of online loan applications, providing Filipinos with an easy and secure way to access loans. With online loan apps, Filipinos can access loans quickly and conveniently, without having to go through a […]

Tag Archives: loans philippines

The Philippines has some of the most competitive online loan interest rates and fees in the world. With competitive rates and fees, online loans in the Philippines offer borrowers a convenient and fast way to access the funds they need. These loans can be used for a variety of needs, ranging from home improvements to […]

MabilisCash emerges as a beacon of innovation, providing swift and reliable online lending solutions in the Philippines. This comprehensive review aims to delve into the intricacies of MabilisCash, shedding light on its features, benefits, and the overall experience it offers to users seeking efficient access to financial resources. Understanding MabilisCash MabilisCash is a cutting-edge online […]

In the Philippines, loan apps have become increasingly popular as they provide easy access to borrowing money through smartphones. This article aims to guide Filipinos in choosing the best online loan app that meets their financial needs. We will discuss important factors to consider, such as legality, eligibility requirements, loan terms, interest rates, security measures, […]

In the ever-evolving landscape of financial services, online lending platforms have become integral to meeting the diverse needs of individuals and businesses. Kviku, a prominent player in this domain, has garnered attention for its commitment to providing fast, convenient, and flexible financial solutions. In this article, MrCashLoan PH will delve into the various facets of […]

In the financial landscape of the Philippines, the salary loan has emerged as a crucial lifeline for many Filipinos, serving as a means to cover bills and unexpected expenses before the arrival of the next paycheck. Particularly, the Social Security System (SSS) salary loan stands out as a wise choice for individuals facing financial challenges. […]

Are you in need of extra cash? In the Philippines, the process of obtaining a loan often involves meticulous submission of various requirements. However, there are numerous options available for those seeking quick and easy loan application processes, particularly for individuals who require immediate financial assistance or lack sufficient income documentation. Easy Loan Application: Where […]

Discover a diverse array of personal loan offers from major banks, all conveniently gathered in one location. Ensure a wise decision by selecting the option that aligns perfectly with your requirements. In this article, MrCashLoan PH navigates through the diverse offerings of the most prominent banks, providing you with a consolidated resource to make an […]

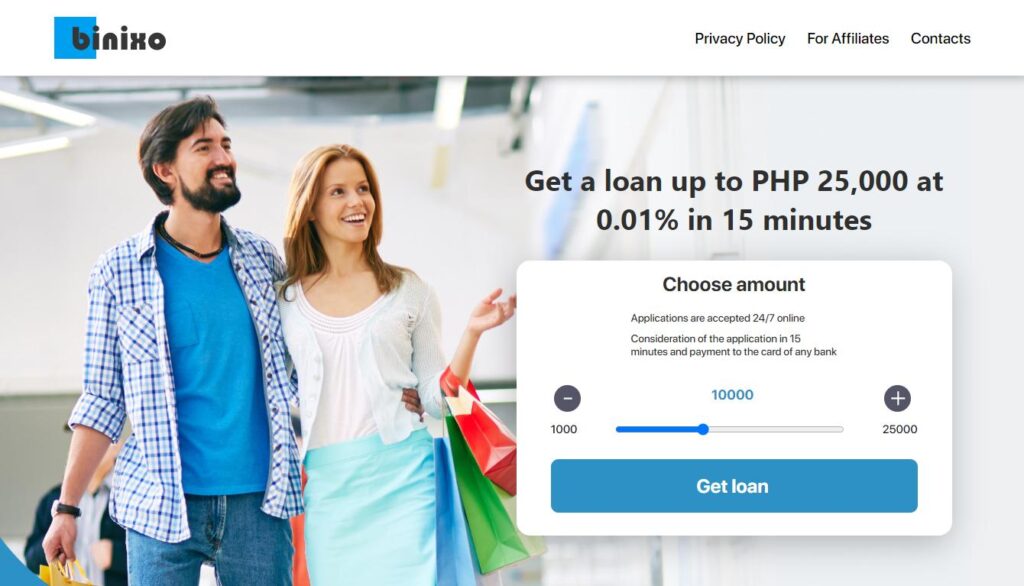

In the rapidly evolving landscape of financial services, Binixo Loans has emerged as a focal point, prominently featured on MrCashLoanPH as a distinguished online lending platform in the Philippines. This thorough review seeks to meticulously examine the legitimacy, registration status, and operational intricacies of Binixo Loans. APPLY BINIXO LOAN Binixo Loan Overview Binixo Loan Review […]

OKPeso positions itself as a swift and convenient online loan application, eliminating the need for collateral. Operated by Codeblock Lending Inc., a reputable financial institution registered with the Securities and Exchange Commission (SEC), it offers borrowers the opportunity to secure loans of up to ₱20,000 with a repayment window spanning from 96 to 365 days. […]